Why Loan Disclosure Is More Important than Net Zero Membership

Some major U.S. banks recently withdrew from the Net-Zero Banking Alliance. Alliance members are committed to aligning their lending, investment, and capital markets activities with Net Zero greenhouse gas emissions by 2050. Membership in a climate-focused alliance is indicative of banks’ overall approach to climate change and sustainability. What is the significance of the U.S. […]

Some major U.S. banks recently withdrew from the Net-Zero Banking Alliance. Alliance members are committed to aligning their lending, investment, and capital markets activities with Net Zero greenhouse gas emissions by 2050.

Membership in a climate-focused alliance is indicative of banks’ overall approach to climate change and sustainability. What is the significance of the U.S. banks’ withdrawal from the climate-focused alliance?

ISS STOXX rates the sustainability profiles of more than 200 U.S. banks. These banks’ disclosures on climate-related risks are evaluated and scored to provide insight into how they execute their climate strategies. The available disclosure information suggests that the banks’ membership in or withdrawal from a climate alliance may not have a significant impact on their sustainability profiles.

U.S. Banks: Sustainability and Lending Guidelines

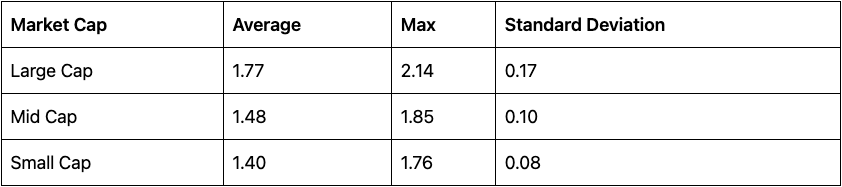

Table 1 shows the overall ESG Corporate Rating scores of U.S. banks, distributed by market cap. These scores represent the banks’ sustainability rating in different market cap categories.

Table 1: Overall ESG Corporate Rating Scores, by Market Cap

Note: The dataset covers 202 banks. Scores of 1.00 – <1.75 = Poor; 1.75 – <2.50 = Medium; 2.50 – <3.25 = Good; 3.25 – <4.00 = Excellent.

Source: ISS STOXX

The table shows the following ESG Corporate Rating scores: average, maximum, and standard deviation at three market cap intervals to provide an understanding of the range of scores across each market cap segment.

The large cap segment has both the highest average ESG score as well as the highest maximum score within the category, although it also has the highest variation, as per its standard deviation. Larger cap firms generally have access to greater resources; however, our methodology implements a size adaptation to avoid size bias creeping into the scores.

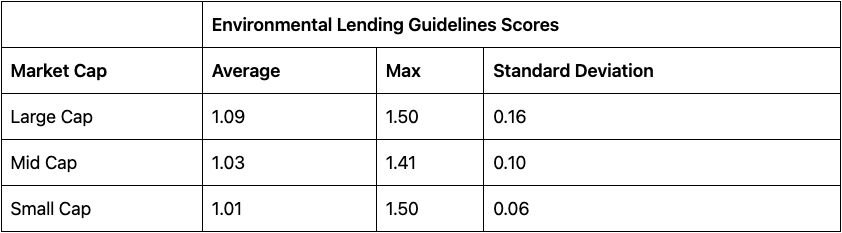

Focusing on lending guidelines provides a more specific evaluation of the execution of banks’ climate-oriented agenda. Table 2 shows specific scores pertaining to banks’ environmental lending guidelines and their lending guidelines for three specific industries: coal fire plants, mining, and oil and gas.

Table 2: Environmental Lending Guideline Scores

Note: The dataset covers 202 banks. Scores of 1.00 – <1.75 = Poor; 1.75 – <2.50 = Medium; 2.50 – <3.25 = Good; 3.25 – <4.00 = Excellent.

Source: ISS STOXX

Banks’ environmental lending guidelines reveal a low average score across all market cap segments, which reflects low disclosure and/or a low commitment at a company level.

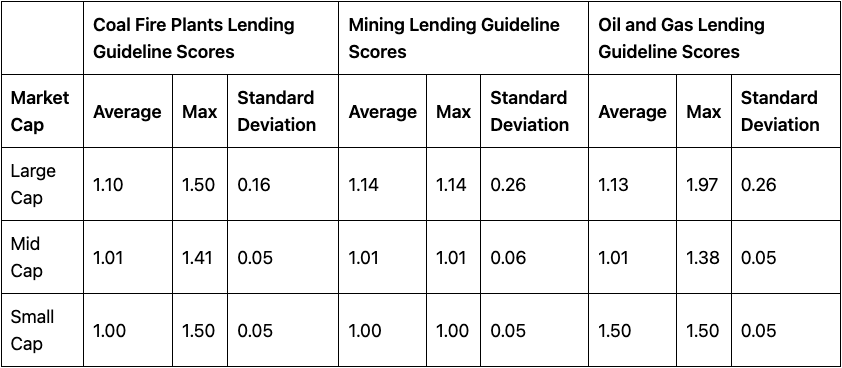

Looking at a more industry-specific lending guideline perspective confirms the limited disclosure provided by banks regarding their environmental-related lending processes. The lending guidelines for the three industry segments—Coal Fire Plants, Mining, and Oil and Gas—also have low scores across all segments (Table 3).

Table 3: Lending Guideline Scores for Coal Fire Plants, Mining, and Oil and Gas

Note: The dataset covers 202 banks. Scores of 1.00 – <1.75 = Poor; 1.75 – <2.50 = Medium; 2.50 – <3.25 = Good; 3.25 – <4.00 = Excellent.

Source: ISS STOXX

Nevertheless, the Oil and Gas industry has some large cap companies able to reach a score close to 2 and also has the largest variation in scoring, together with large cap Mining companies.

Conclusion

The U.S. banks rated by ISS STOXX have limited disclosure on sustainability. Banks exiting the climate-focused alliance therefore seems unlikely to have a major impact on investors’ ability to assess the banks’ sustainability alignment.

The low level of concern for sustainability, implied by their low level of disclosure, may be because banks’ credit lines are likely of much shorter duration relative to the longer-dated risks that often most concern environmentally focused investors. Banks may perceive the expected loss from environmental-related risks to be further into the future than the period covered by the terms of their loans.

Nevertheless, banks’ processes are generally designed to avoid incurring bad loans and writing off assets. They are thus likely to undergo a significant level of due diligence that is not shared in their regular reporting cycle. Gaining greater disclosure about the ways in which risks are evaluated and quantified by a bank is likely of more value to sustainability stakeholders compared to the bank’s membership in a particular alliance.

Explore ISS ESG solutions mentioned in this report:

- Identify ESG risks and seize investment opportunities with the ISS ESG Corporate Rating.

By: Roberto Lampl, Managing Director, Corporate Ratings Research, Global Multi Sector Head, ISS STOXX