Investor Lawsuit Filed against Globe Life Inc. amid Report of Insurance Fraud and Sexual Harassment

In April 2024, Globe Life Inc.’s stock price fell by over 50% after short seller Fuzzy Panda issued a report describing allegations of widespread insurance fraud and a hostile workplace where sexual harassment and drug use went “unchecked.” A securities class action lawsuit based on these allegations was filed shortly thereafter. The lawsuit asserted the […]

In April 2024, Globe Life Inc.’s stock price fell by over 50% after short seller Fuzzy Panda issued a report describing allegations of widespread insurance fraud and a hostile workplace where sexual harassment and drug use went “unchecked.”

A securities class action lawsuit based on these allegations was filed shortly thereafter. The lawsuit asserted the insurance company made misleading statements about its revenue growth and code of business conduct and ethics. According to the complaint, Globe Life Inc. concealed that its subsidiaries were underwriting life insurance policies for dead and fictitious people, as well as adding policies to existing customers’ accounts without their consent. The lawsuit also specifically alleges the life insurer, formerly known as Torchmark, falsely assured investors of an “inclusive and welcoming environment” where violence, threatening behavior, and drug use would not be tolerated.

In the Fuzzy Panda report, which relied on interviews with former executives and agents, Globe Life Inc. was accused of the following:

- Writing insurance policies for deceased and fictitious people

- Forging signatures on policy documents

- Withdrawing funds from consumers’ bank accounts without proper authorization

- Using fictitious bank accounts to create fake insurance policies so that agents “hit” their bonuses

- Orchestrating a $65 million bribery and kickback scheme to make money from the company’s own recruits

The insurer has also now disclosed a federal investigation by the Department of Justice, including subpoenas received in late 2023 that raised questions about sales tactics used by agents. Another short-seller Viceroy Research has also commenced an investigative report targeting Globe Life.

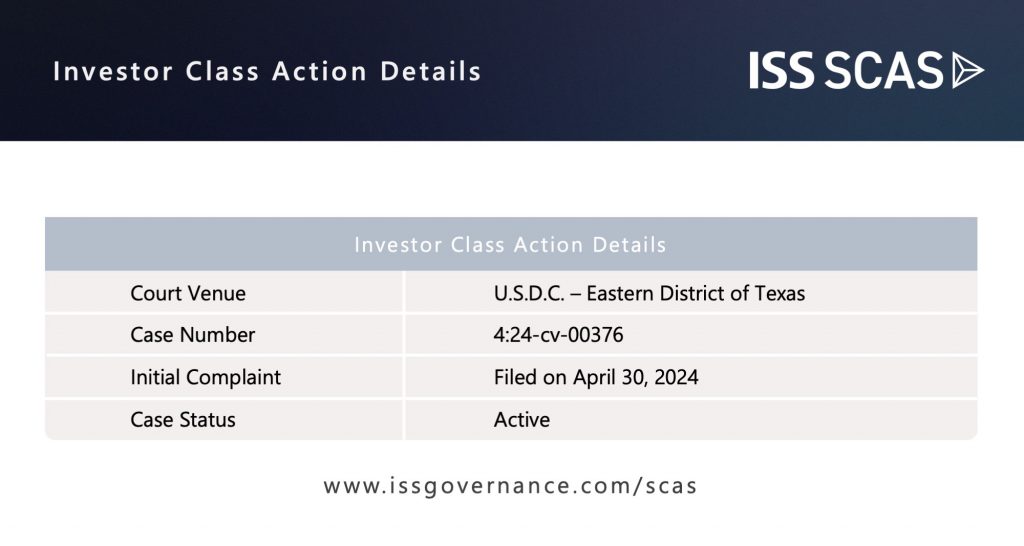

The lawsuit — which was recently filed — has a long way to go before any potential settlement is reached. The initial complaint was filed on April 30, 2024, by Bernstein Litowitz Berger & Grossmann on behalf of the City of Miami General Employees’ & Sanitation Employees’ Retirement Trust. However, investors have until July 1, 2024, to seek appointment as lead plaintiff.

Securities lawsuits alleging misstatements or omissions of sexual misconduct have had mixed success in federal courts. While Signet settled for $240 million and CBS for $14.75 million, other cases, against Activision Blizzard, Papa Johns, and Teladoc, have been dismissed. Whether the claims by Fuzzy Panda are substantiated and the securities lawsuit against Globe Life survives a motion to dismiss remains to be seen.

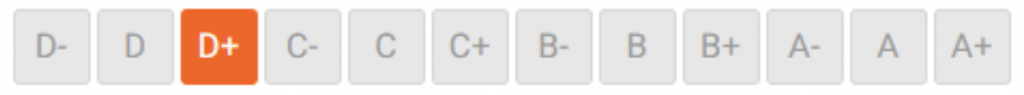

However, some ESG insights from Globe Life Inc. are worth considering. According to ISS ESG Gateway, Globe Life Inc. exhibits an ESG Corporate Rating of D+ (Figure 1), indicating a ‘poor’ score as per ISS ESG Corporate Rating Methodology. ISS ESG assesses ESG corporate performances on an absolute twelve-point letter and underlying numerical scale, from A+/4.00 (excellent performance) to D-/1.00 (poor performance).

Figure 1: ESG Corporate Ratings – Global Life Inc.

Source: ISS ESG Gateway

ISS Securities Class Action Services (SCAS) monitors claims through the entire securities class action lifecycle, from filing to settlement and disbursement for our institutional and investor clients with the goal of maximizing their recoveries.

This high-profile action illustrates how a comprehensive ESG framework can support investors in identifying and preventing risks.

By: Ivar Eilertsen, Global Head ISS SCAS