Single-family rentals continue to grow in BTR communities

Single-family rentals continue to grow in BTR communities 0 qpurcell Mon, 03/04/2024 - 12:25 Multifamily Housing Single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters. Quinn Purcell, Managing Editor The Yardi Matrix single-family rental (SFR) report gives an overview of the growing SFR industry, including four of the biggest demand drivers and development trends. MFPRO+ Research Multifamily Housing Apartments Designers Industry Research Interior Architecture Market Data The Single-Family Rentals in Build-to-Rent Communities report by Yardi Matrix shares an update of the SFR market in 2024. Overall, single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.Over two-thirds of the top 30 metros have higher occupancy rates from single-family rentals in BTR communities than other multifamily assets.4 Biggest Demand Drivers for Single-Family RentalsBut aside from price, what’s driving the demand? Four of the biggest demand drivers for single-family rentals are work-from-home professionals, household growth, the declining affordability of homeownership, and the demographics of Millennials and blue-collar workers.1. Renters working from homeBecause more than half (52%) of full-time workers are now returning back to the office, hybrid work is becoming the norm. Single-family rentals are more accommodating to this shifting demographic than traditional apartments; SFR offers a quieter environment and more space inside the home for the hybrid worker.2. Household formation growth during the pandemicDemand is also driven by household formation growth during the pandemic as a result of: Employment/wage growth.Stimulus payments.Increased savings.3. Declining homebuying affordabilityAccording to the Yardi Matrix report, 61% of renters in the largest metros are priced out of homebuying. The average home mortgage payment reached $2,547 at the end of 2023. Compare this to the average rent of $1,734 and renting looks like the better deal.As the affordability of buying a home decreases, single-family rentals are prime for Millennials and blue-collar workers who would like to buy a house, but can’t.4. Specific demographicsThose averaging a salary of $60,000 to $70,000 a year, individuals aged 24 to 40, and Millennials/blue-collar workers are largely driving the demand for single-family rentals in built-to-rent communities.SFR development trends indicate that flexible designs and lot size by location are based on consumer preferences. For example, young singles and couples prefer pet-friendly units, while young families prefer large common areas.RELATED: Multifamily rent remains flat at $1,710 in JanuaryDevelopment TrendsThe four biggest single-family rental development trends as of 2024 include:Amenities. On-site maintenance and community areas are the most popular. Better parking, storage, privacy, and yard space is also highly desired.Smart home technology. This has become a “must” and will likely be standard soon, according to Yardi. Developers should plan for future demand such as electric vehicle charging in garages.Homes designed for frequent moving. Single-family rentals are using resilient materials like laminate faux wood flooring to maintain a durable, sleek look. Units are designed with wider hallways to accommodate the moving of furniture in and out of the home.Flexibility. Target demographics and location influence the design of build-to-rent communities. While younger renters would prefer pet-friendly units and large common areas, older singles and couples prefer an attached garage.Click here to view the full Yardi Matrix Single-Family Rentals in Build-to-Rent Communities report.

Single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

Quinn Purcell, Managing Editor

The Yardi Matrix single-family rental (SFR) report gives an overview of the growing SFR industry, including four of the biggest demand drivers and development trends.

The Single-Family Rentals in Build-to-Rent Communities report by Yardi Matrix shares an update of the SFR market in 2024. Overall, single-family rentals are continuing to grow in built-to-rent communities. Both rent and occupancy growth have been strong in recent months while remaining a financially viable option for renters.

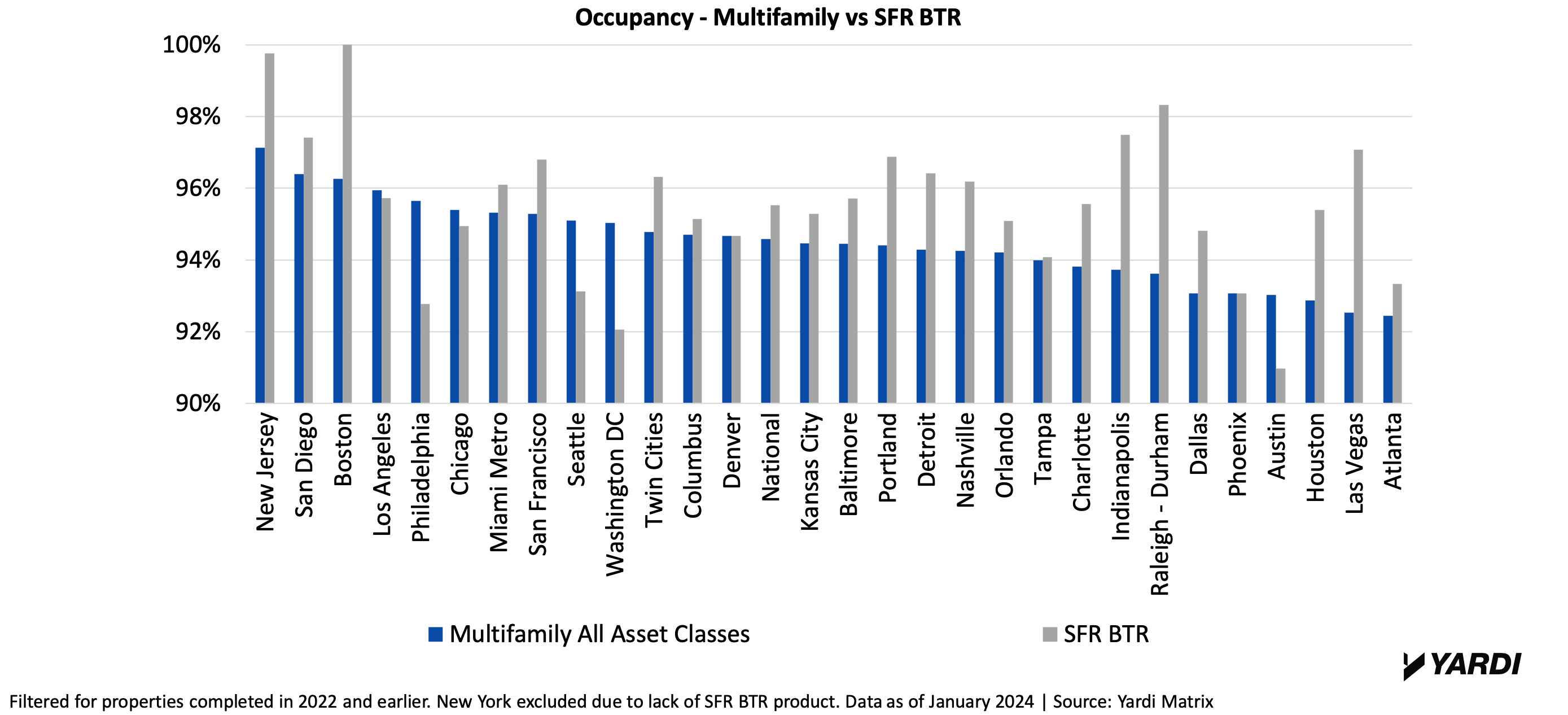

Over two-thirds of the top 30 metros have higher occupancy rates from single-family rentals in BTR communities than other multifamily assets.

4 Biggest Demand Drivers for Single-Family Rentals

But aside from price, what’s driving the demand? Four of the biggest demand drivers for single-family rentals are work-from-home professionals, household growth, the declining affordability of homeownership, and the demographics of Millennials and blue-collar workers.

1. Renters working from home

Because more than half (52%) of full-time workers are now returning back to the office, hybrid work is becoming the norm. Single-family rentals are more accommodating to this shifting demographic than traditional apartments; SFR offers a quieter environment and more space inside the home for the hybrid worker.

2. Household formation growth during the pandemic

Demand is also driven by household formation growth during the pandemic as a result of:

- Employment/wage growth.

- Stimulus payments.

- Increased savings.

3. Declining homebuying affordability

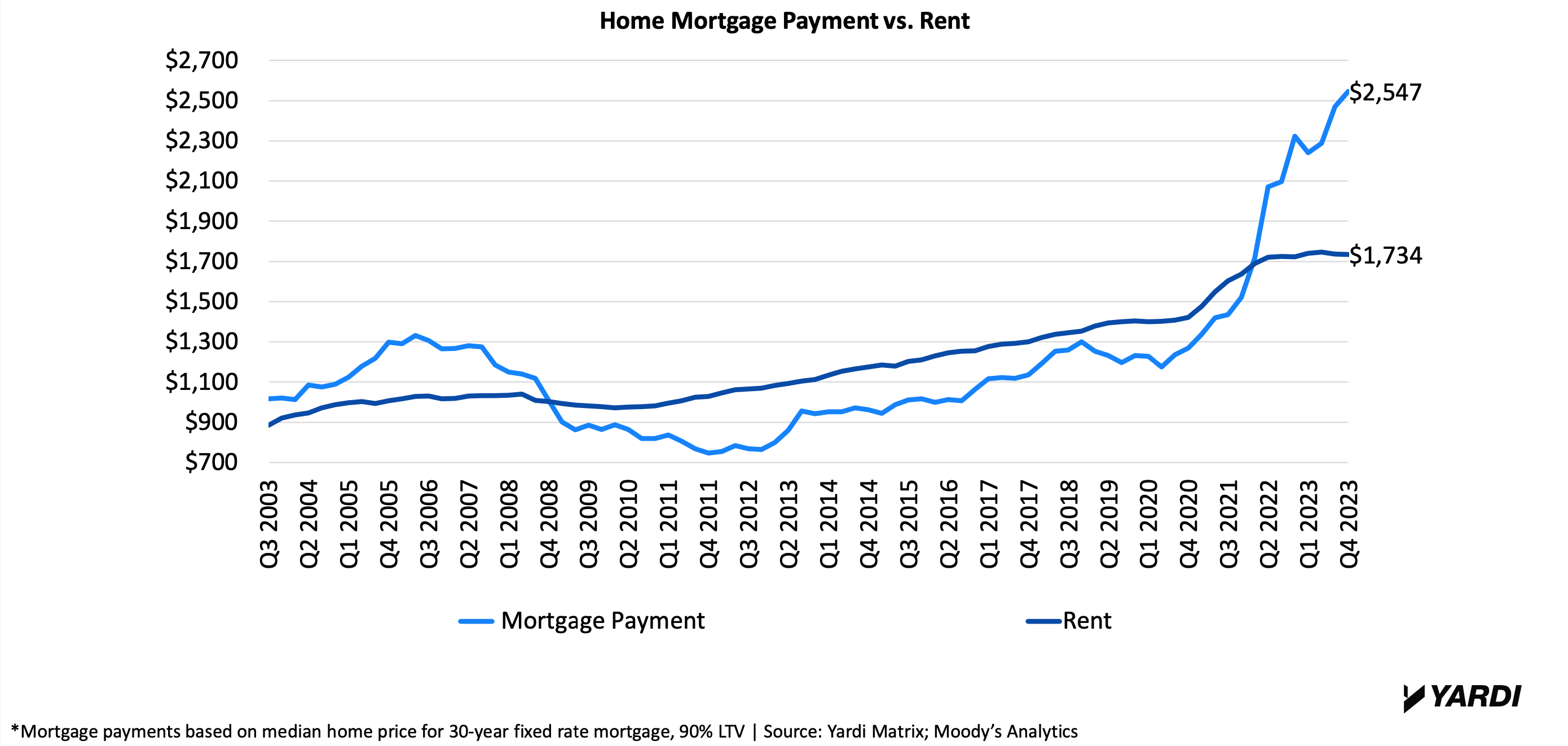

According to the Yardi Matrix report, 61% of renters in the largest metros are priced out of homebuying. The average home mortgage payment reached $2,547 at the end of 2023. Compare this to the average rent of $1,734 and renting looks like the better deal.

As the affordability of buying a home decreases, single-family rentals are prime for Millennials and blue-collar workers who would like to buy a house, but can’t.

4. Specific demographics

Those averaging a salary of $60,000 to $70,000 a year, individuals aged 24 to 40, and Millennials/blue-collar workers are largely driving the demand for single-family rentals in built-to-rent communities.

SFR development trends indicate that flexible designs and lot size by location are based on consumer preferences. For example, young singles and couples prefer pet-friendly units, while young families prefer large common areas.

RELATED: Multifamily rent remains flat at $1,710 in January

Development Trends

The four biggest single-family rental development trends as of 2024 include:

- Amenities. On-site maintenance and community areas are the most popular. Better parking, storage, privacy, and yard space is also highly desired.

- Smart home technology. This has become a “must” and will likely be standard soon, according to Yardi. Developers should plan for future demand such as electric vehicle charging in garages.

- Homes designed for frequent moving. Single-family rentals are using resilient materials like laminate faux wood flooring to maintain a durable, sleek look. Units are designed with wider hallways to accommodate the moving of furniture in and out of the home.

- Flexibility. Target demographics and location influence the design of build-to-rent communities. While younger renters would prefer pet-friendly units and large common areas, older singles and couples prefer an attached garage.

Click here to view the full Yardi Matrix Single-Family Rentals in Build-to-Rent Communities report.