Potential Blockbuster $362.5 Million Settlement Proposed to Resolve Long Standing Securities Fraud Class Action Against General Electric

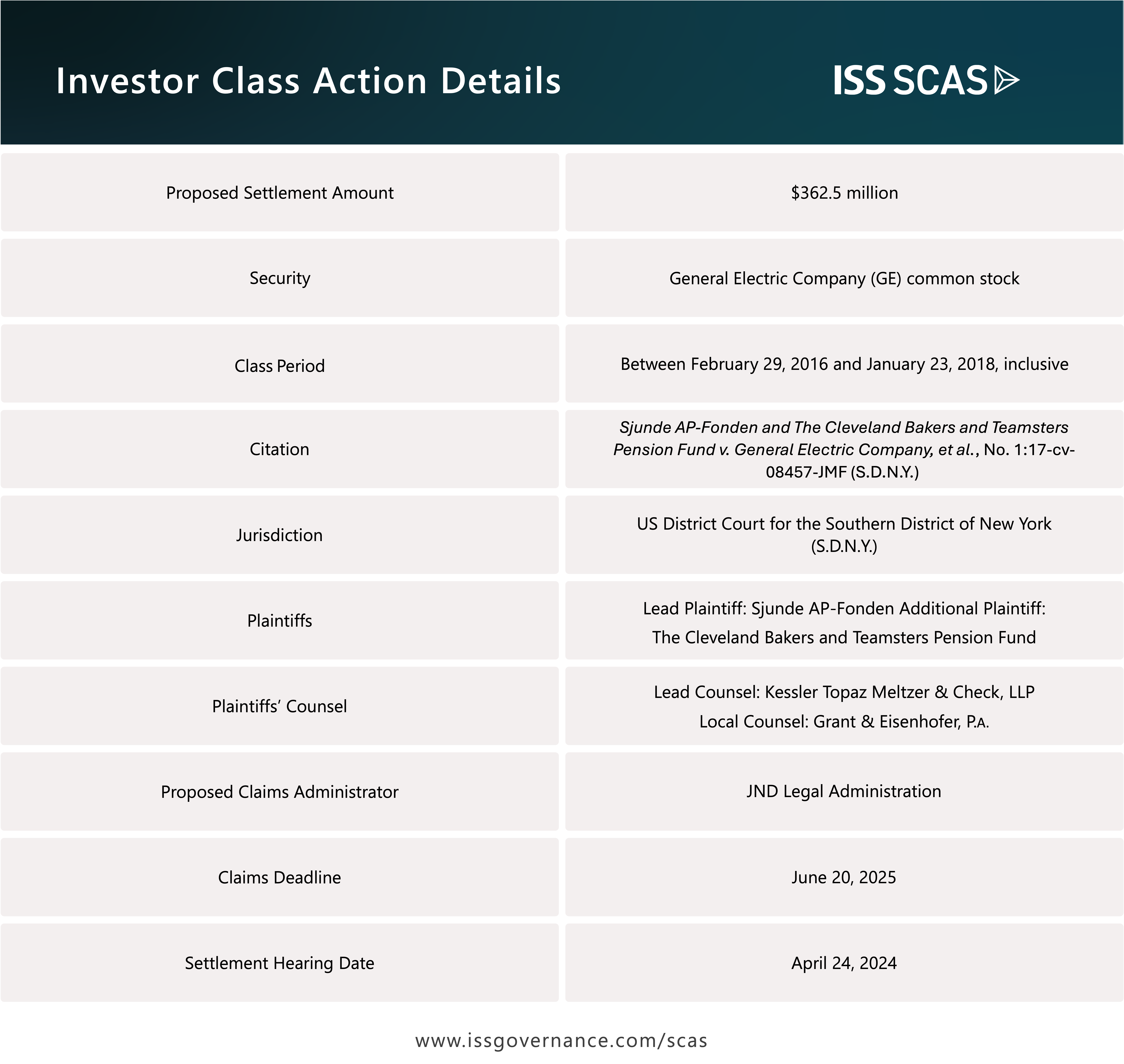

On November 25, 2024, plaintiffs Sjunde AP-Fonden and The Cleveland Bakers And Teamsters Pension Fund (together “Plaintiffs”) moved Judge Jesse Furman of the U.S. District Court for the Southern District of New York (the “Court”) for preliminary approval of a proposed $362.5 million cash settlement, which will resolve securities fraud class action claims against the […]

On November 25, 2024, plaintiffs Sjunde AP-Fonden and The Cleveland Bakers And Teamsters Pension Fund (together “Plaintiffs”) moved Judge Jesse Furman of the U.S. District Court for the Southern District of New York (the “Court”) for preliminary approval of a proposed $362.5 million cash settlement, which will resolve securities fraud class action claims against the General Electric Company (“GE” or the “Company”) and its former CFO (together “Defendants”).1 Plaintiffs stated that the parties reached the proposed settlement after seven years of “highly contested and vigorous litigation” and less than a month before trial in the action was set to commence. The Gravamen of Plaintiffs’ surviving allegations in the action were that GE’s public disclosures during the relevant time period concealed material facts concerning GE’s reliance on intercompany factoring transactions to offset weakness in its power unit’s cash flows from operations, thereby inflating the price of GE common stock. Plaintiffs alleged that investors were harmed when the truth was revealed over a series of alleged partial disclosures.

Plaintiffs’ Allegations

Prior to the events underlying this action, GE’s renowned former CEO, Jack Welch, had built GE into a conglomerate that was one of the largest and most famous companies in the world. But after Welch had left GE, the 2001 recession and the 2008 great financial crisis occurred, and the Company’s fortunes and share price began to lag. Ultimately, the Company has split into different companies by business lines, such as aviation or health care, while today various technology companies have market capitalizations far larger than any former GE division.

Six amended complaints were filed in this action.2 Plaintiffs at one point had made claims against GE and a number of the Company’s executives, involving two primary alleged frauds. First, Plaintiffs claimed that GE covered up massive liabilities in its long-term care insurance (“LTC”) business—insurance policies sold to cover the cost of end-of-life care in nursing homes and other facilities. They alleged that GE had mispriced these policies resulting in looming obligations. Plaintiffs asserted that GE concealed these liabilities by removing certain disclosures about LTC liabilities from the Company’s SEC filings, representing that GE had exited the LTC business successfully, and refusing to quantify reserves directly attributable to LTC policies in GE’s financial statements.

Second, Plaintiffs claimed that GE misrepresented the performance of its power unit through various accounting manipulations related to long term service agreements (“LTSAs”) on power plants, turbines, and generators. The timing of recognition of revenues on such contracts is complicated, but Plaintiffs alleged, among other things, that GE used a variety of faulty assumptions about contracts to inflate revenues. Most pertinently, Plaintiffs alleged that to inflate the cashflow of GE’s power unit, the Company relied on an unsustainable and costly process of factoring the receivables from LTSAs by selling them to GE’s capital business in exchange for cash—effectively bringing cash flows to the present at the expense of future cash flows.

Plaintiffs asserted that because of these two alleged frauds, GE’s stock price was inflated, and investors were harmed when its stock price declined when the truth was revealed over a series of disclosures.

Brief Summary of the Seven Years Long Litigation

The litigation was indeed long and sprawling. The initial complaint was filed on November 1, 2017, and the Court later appointed a lead plaintiff, which eventually filed two amended complaints. However, on February 20, 2018, Plaintiffs filed a new action against GE and certain of its executives, expanding both the scope of the allegations and also the length of the asserted class period. Plaintiffs intervened and moved the court to reopen the lead plaintiff appointment process, which the Court granted. Ultimately the Court appointed Plaintiffs to take charge of the action. This was an unusual event, since the prior lead plaintiff and lead counsel were removed from leadership of the case.

Plaintiffs filed four more complaints on July 23, 2018; October 17, 2018; October 25, 2019; and May 13, 2022. The Court granted two motions to dismiss in part on August 29, 2019 (ECF No. 185) and January 29, 2021 (ECF No. 206), Plaintiffs’ motion for class certification in part on April 11, 2022 (ECF No. 314), and Defendants’ motion for summary judgement in part on September 28, 2023 (ECF No. 413). After a class notice was sent out, 318 shareholders requested exclusion. The parties represented that they also prepared extensively for trial, including by filing a joint pretrial statement, various evidentiary motions, and an amended trial submission. When the parties reached the proposed settlement, trial was imminent.

Ultimately, at the time of settlement, only claims remained against GE and its former CFO, and the Court had dismissed all allegations except those related to GE’s factoring of LTSA receivables. Further, the Court had eliminated certain alleged corrective disclosures.

SEC Proceedings Against GE Result in a $200 Million Fair Fund

Separate from the class action, the SEC had established a Fair Fund of $200 million in civil money penalties paid by GE to resolve the SEC’s charges for failing to disclose material information relating to the Company’s power and insurance businesses. The SEC had found that:3 GE had misled investors by not explaining that $1.4 billion in 2016 and $1.1 billion in the first three quarters of 2017 of GE’s power segment’s profits stemmed from reductions in costs estimates on LTSAs; that GE failed to disclose that its reliance on factoring of LTSA receivables increased present industrial cash flow at the expense of future years; and that GE had failed to disclose rising claim costs and resulting potential for materials losses in its LTC business. The SEC intended the fund to compensate investors who purchased GE common stock through a US stock exchange between October 16, 2015, and January 16, 2018. The claims deadline was October 19, 2022.

The Proposed $362.5 Million Class Action Settlement

If the terms of the class action settlement are approved, the class as previously certified by the court in the action—all persons and entities that purchased or acquired GE common stock between February 29, 2016, and January 23, 2018, inclusive and were damaged thereby—could be eligible for a share of the settlement. A settlement hearing is scheduled for April 24, 2025, and the deadline for filing a claim is June 20, 2025. Importantly, this would rank as one of the top 100 private securities class action recoveries in the United States ever, if approved, is one of the largest settlements announced in 2024, will feature prominently in the 2025 settlements, and likely is the end to a sprawling and hard-fought litigation involving a marquee company.

Plaintiffs contend that the $362.5 million proposed settlement amount is appropriate as it recovers 8%-36% of the $1 to $4.5 billion in potential recoverable damages and because of risks of prevailing at trial.

1 Sjunde AP-Fonden and The Cleveland Bakers and Teamsters Pension Fund v. General Electric Company, et al., No. 1:17-cv-08457-JMF. See, at ECF No. 475 for Plaintiffs’ settlement memo and ECF No. 476 for the settlement agreement.

2 Id. at ECF Nos. 73, 83, 157, 179, 191, and 327. See id. at ECF No. 1 for the initial complaint.

3 In the Matter of General Electric Company, No. 3-20165.

“No portion of this insight constitutes legal or financial advice, and no attorney-client relationship is intended or is established.”

By:

Donald F. Grunewald, Director of Litigation Analysis, ISS SCAS