New download: BD+C's May 2024 Market Intelligence Report

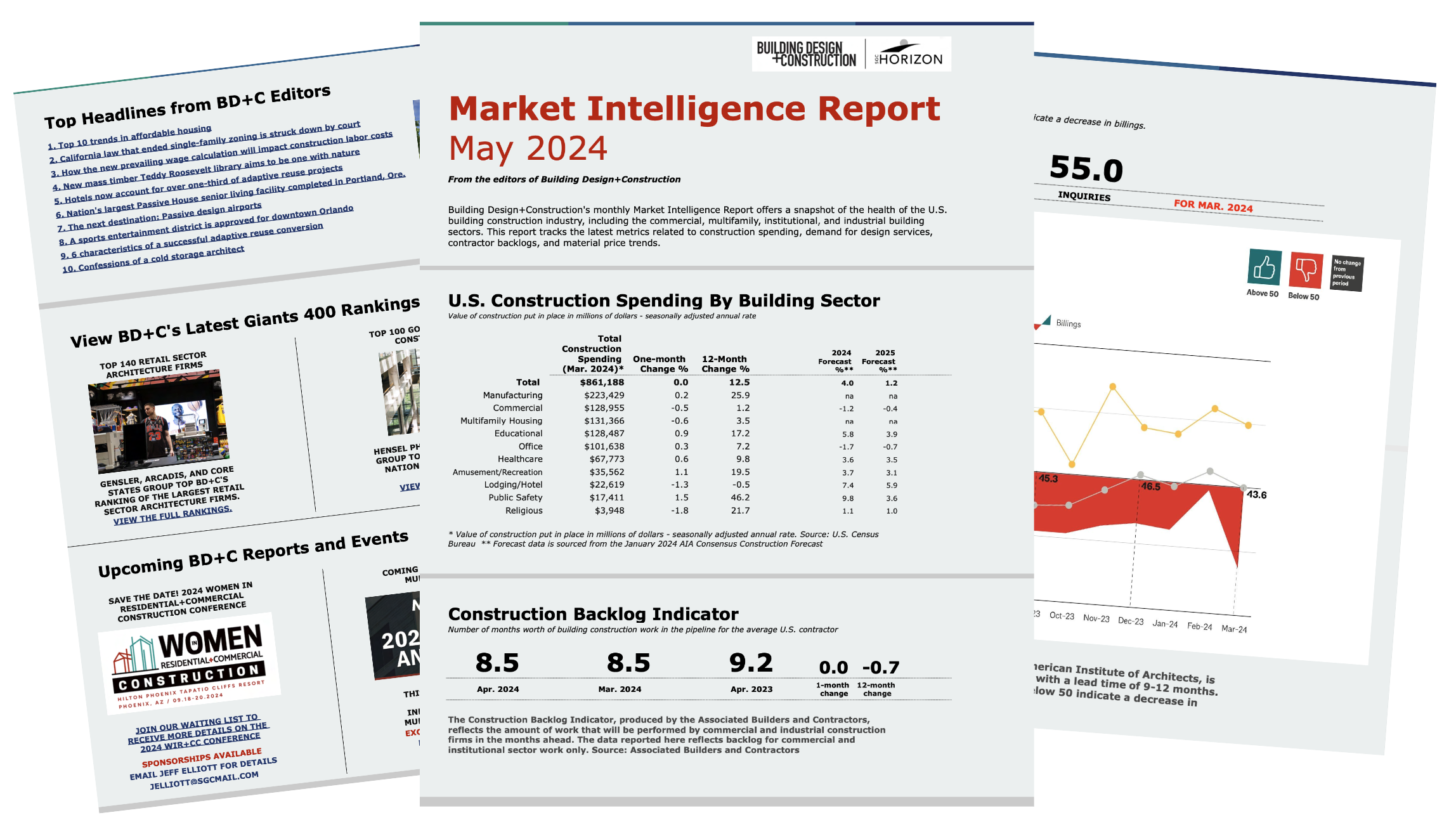

New download: BD+C's May 2024 Market Intelligence Report 0 dbarista Thu, 05/16/2024 - 13:35 Construction Costs Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends. BD+C STAFF This monthly report offers a snapshot of the health of the U.S. building construction industry. Contractors Designers Designers / Specifiers / Landscape Architects Engineers Facility Managers Architects Building Owners Construction Costs Market Data Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.Data for the Market Intelligence Report is gleaned from reputable economic sources, including the American Institute of Architects, Associated Builders and Contractors, and the U.S. Census Bureau.Here are some of the highlights from the May 2024 report: U.S. construction spending for commercial, institutional, industrial, and multifamily buildings was flat in March 2024 vs. the previous month, but 12.5% higher than March 2023.The education, amusement/recreation, public safety, manufacturing, and religious sectors all saw double-digit year-over-year growth in construction spending.After a relatively solid showing in February, the Architectural Billings Index took a major step back in March, dropping 5.9 points to 43.6. According to AIA, this marks the 14th consecutive month of declining billings at firms.Commentary on the latest ABI report from Kermit Baker, PhD, AIA Chief Economist: "This marked the 14th consecutive month of declining billings at firms as inflation, supply chain issues, and other economic challenges continue to affect business. While inquiries into new projects have continued to grow during that period, it has been at a slower pace than in 2021 and 2022. More notably, the value of new signed design contracts was flat in March, which has generally been the trend for the last year and a half. This shows that clients are interested in starting new projects but remain hesitant to sign a contract and officially commit to those projects. However, most firms report that they still have strong project backlogs of 6.6 months, on average, so even with the ongoing soft patch, they still have work in the pipeline."Construction backlogs remain steady: The average U.S. contractor had 8.5 months worth of building construction work in the pipeline as of April 2024, flat from March 2024, but down 0.7 months from the same time last year. Construction material prices rose 0.5% in April 2024 vs. the previous month, and were 2.3% higher than a year ago. This marks the fourth straight month of rising prices, after a streak of three consecutive monthly declines.Commentary on the latest construction materials price report from Anirban Basu, ABC Chief Economist: “Construction input prices jumped half a percentage point higher in April and have increased 3.5% over the first four months of the year. While iron, steel, asphalt and gypsum product prices fell in April, oil and copper prices surged, driving the monthly increase. Rising input prices will put pressure on profits at a time when nearly 1 in 4 contractors expect their margins to contract over the next two quarters, according to ABC’s Construction Confidence Index. Perhaps more importantly for contractors, the overall Producer Price Index reading for final demand goods and services increased 0.5% in April. This is yet another sign that inflation is accelerating and suggests that interest rates are set to stay higher for longer."

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

BD+C STAFF

This monthly report offers a snapshot of the health of the U.S. building construction industry.

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Data for the Market Intelligence Report is gleaned from reputable economic sources, including the American Institute of Architects, Associated Builders and Contractors, and the U.S. Census Bureau.

Here are some of the highlights from the May 2024 report:

- U.S. construction spending for commercial, institutional, industrial, and multifamily buildings was flat in March 2024 vs. the previous month, but 12.5% higher than March 2023.

- The education, amusement/recreation, public safety, manufacturing, and religious sectors all saw double-digit year-over-year growth in construction spending.

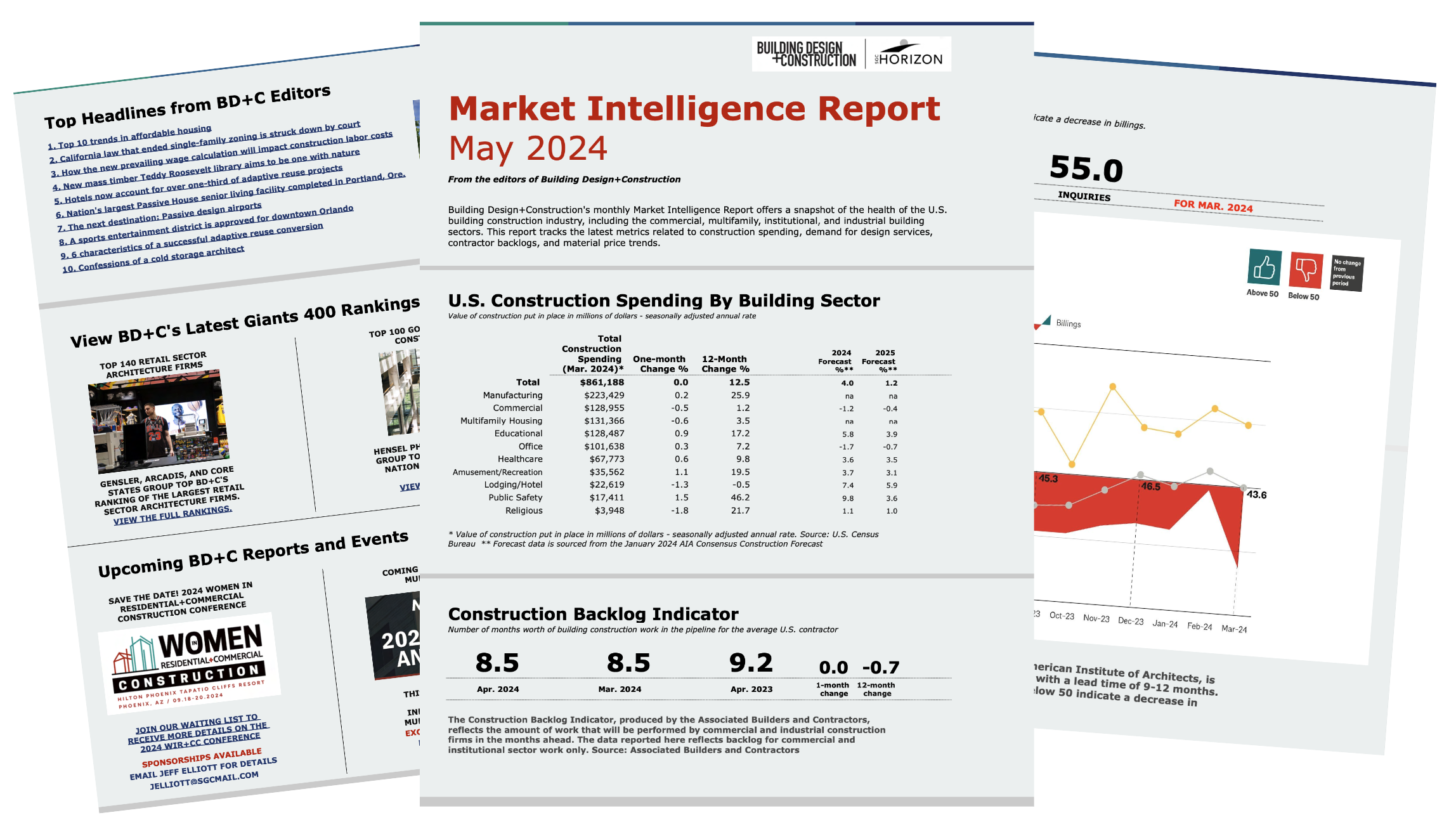

- After a relatively solid showing in February, the Architectural Billings Index took a major step back in March, dropping 5.9 points to 43.6. According to AIA, this marks the 14th consecutive month of declining billings at firms.

- Commentary on the latest ABI report from Kermit Baker, PhD, AIA Chief Economist: "This marked the 14th consecutive month of declining billings at firms as inflation, supply chain issues, and other economic challenges continue to affect business. While inquiries into new projects have continued to grow during that period, it has been at a slower pace than in 2021 and 2022. More notably, the value of new signed design contracts was flat in March, which has generally been the trend for the last year and a half. This shows that clients are interested in starting new projects but remain hesitant to sign a contract and officially commit to those projects. However, most firms report that they still have strong project backlogs of 6.6 months, on average, so even with the ongoing soft patch, they still have work in the pipeline."

- Construction backlogs remain steady: The average U.S. contractor had 8.5 months worth of building construction work in the pipeline as of April 2024, flat from March 2024, but down 0.7 months from the same time last year.

- Construction material prices rose 0.5% in April 2024 vs. the previous month, and were 2.3% higher than a year ago. This marks the fourth straight month of rising prices, after a streak of three consecutive monthly declines.

- Commentary on the latest construction materials price report from Anirban Basu, ABC Chief Economist: “Construction input prices jumped half a percentage point higher in April and have increased 3.5% over the first four months of the year. While iron, steel, asphalt and gypsum product prices fell in April, oil and copper prices surged, driving the monthly increase. Rising input prices will put pressure on profits at a time when nearly 1 in 4 contractors expect their margins to contract over the next two quarters, according to ABC’s Construction Confidence Index. Perhaps more importantly for contractors, the overall Producer Price Index reading for final demand goods and services increased 0.5% in April. This is yet another sign that inflation is accelerating and suggests that interest rates are set to stay higher for longer."